Three Major Identity Verification Pain Points for Web3 Platforms

As the Web3 ecosystem rapidly evolves, decentralized platforms face unprecedented identity verification challenges. Traditional centralized KYC solutions fundamentally conflict with Web3's decentralized philosophy, forcing platforms to make difficult choices between regulatory compliance and user privacy.

- Privacy breach risk

Traditional KYC processes require users to submit sensitive personal information to centralized databases, which become high-value targets for hackers. Once data breaches occur, users' identity documents, addresses, and financial information face permanent exposure risks.

- Bot and sybil attacks.

The open nature of Web3 platforms makes them fertile ground for automated fraud. Malicious actors can easily create numerous fake accounts to manipulate voting, steal airdrops, and distort market prices, severely damaging platform fairness and user trust.

- High compliance costs.

As global regulatory requirements become increasingly stringent, platforms must satisfy multiple compliance requirements including KYC/AML, accredited investor verification, and transaction monitoring. Traditional solutions not only have high development costs but also require continuous maintenance and updates, placing heavy burdens on smaller projects.These pain points are driving Web3 platforms to seek innovative zero-knowledge proof solutions that can balance privacy protection with regulatory compliance.

1. Pain Point One: How to verify Real Identity Without Compromising Privacy?

The Privacy Risk Dilemma of Traditional KYC

Traditional KYC processes require users to submit government-issued identity documents, proof of address, bank statements, and other sensitive documents, all stored on centralized servers. The risks of traditional credential verification methods are numerous, including database breaches, unsecured front ends, and even disgruntled employees. For Web3 platforms, this centralized data storage model creates additional philosophical conflicts. Users choose Web3 precisely to escape the surveillance and control of traditional financial systems, yet traditional KYC requires them to surrender their most private personal information.

zkMe Solution: zkKYC Compliance Suite

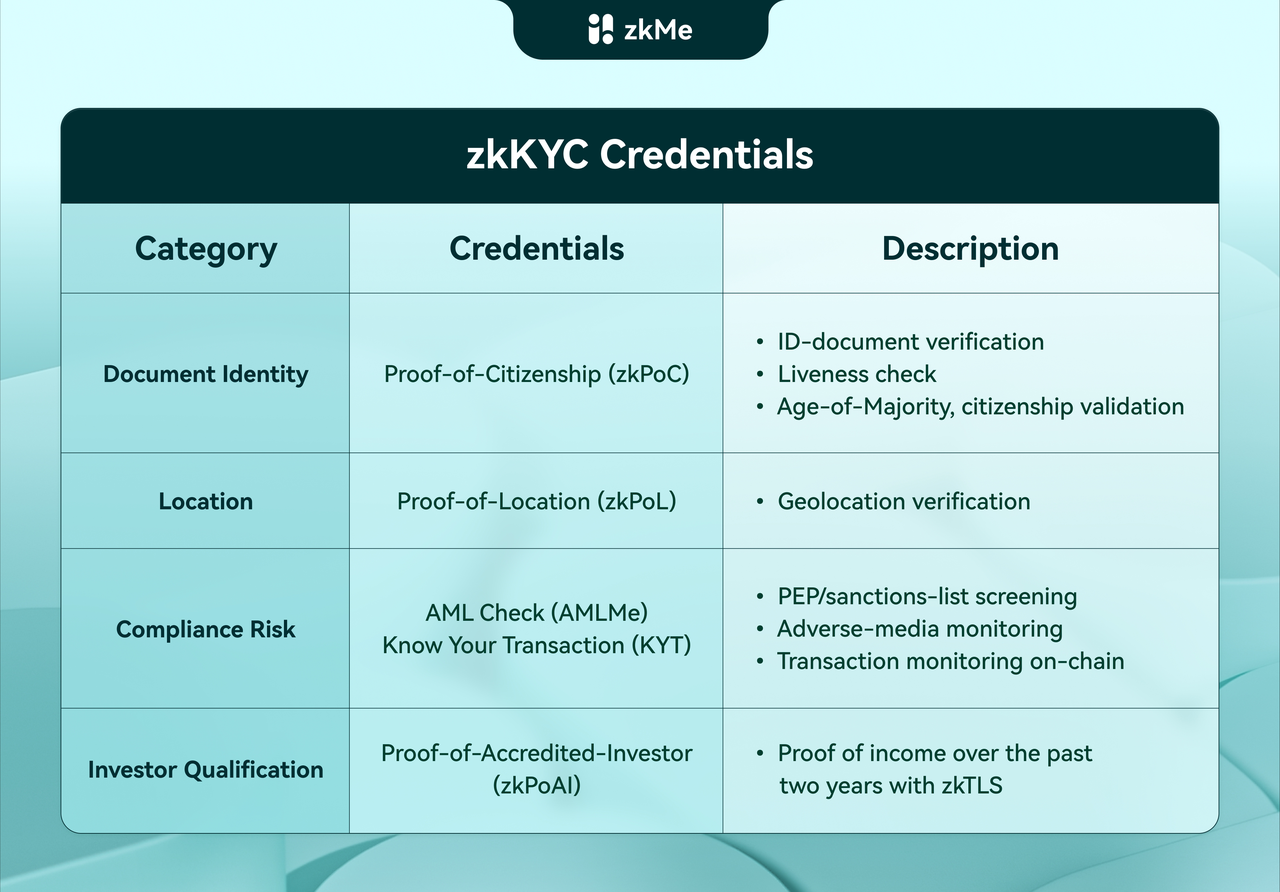

zkMe's zkKYC is the comprehensive Compliance Suite that enables platforms to verify various user credentials through zero-knowledge proofs. The suite contains modular components that can be individually configured based on specific compliance needs:

- zkPoC (Proof-of-Citizenship): ID document verification with liveness checks and age-of-majority validation

- zkPoL (Proof-of-Location): Geolocation verification for regulatory compliance

- AML Check (AMLME): PEP/sanctions-list screening and adverse media monitoring

- KYT (Know Your Transaction): Real-time on-chain transaction monitoring

- zkPoAI (Proof-of-Accredited-Investor): Income verification for qualified investor status

Core Technical Innovation: zkMe's zkKYC enables users to prove their identity compliance without exposing specific personal information. Users complete verification on their local devices, with the system using zero-knowledge proofs to generate cryptographic commitments that prove compliance without revealing underlying data. The zkMe credentials are completely private and secure for users, providing a solution that relieves the liability, maintenance, and resources of maintaining user data through zkMe's secure and private-by-design philosophy, where underlying user data is never shared.

Leading Platform Implementations

Impossible Finance: As a prominent DeFi platform and IDO launchpad on Ethereum, Impossible Finance has deployed zkPoC, AMLMe, and MeID from zkMe's compliance suite. The platform needed to verify participant compliance for its transparent, secure, and accessible financial services while protecting user privacy. Through zkMe's solution, Impossible Finance successfully achieved FATF compliance requirements while maintaining its decentralized characteristics and fair allocation mechanisms.

KyberSwap: This leading multi-chain DEX aggregator supporting 14+ blockchains uses zkPoC and AMLMe to provide unified identity verification across all supported networks. As a platform that aggregates liquidity from over 70 decentralized exchanges, KyberSwap requires robust compliance infrastructure to maintain regulatory standing while offering superior swap rates and cross-chain functionality.

CARV: The cutting-edge Web3 infrastructure platform focused on gaming and AI leverages zkPoC and AMLMe to serve over 500,000 users. CARV's decentralized identity and reputation system requires authentic verification to enable gamers to mint gaming achievements as Soulbound Tokens while maintaining privacy and preventing fraud in gaming communities.

Data Ownership Protocol (DOP): This privacy-focused, Ethereum-based infrastructure protocol uses zkPoC and AMLMe to give users control over their personal financial data and on-chain activities. As a protocol leveraging zero-knowledge proofs and ECDSA signatures, DOP requires sophisticated identity verification that aligns with its privacy-preserving mission.

Alchemy Pay: The leading hybrid crypto-fiat payment platform serving 173 countries implements zkPoC and AMLMe to verify users across its global payment gateway. As a platform bridging traditional fiat systems and cryptocurrency ecosystems, Alchemy Pay requires robust compliance infrastructure to meet diverse regulatory requirements while maintaining seamless user experience.

Results: Privacy-Preserving Compliance at Scale

This innovative approach achieves seemingly impossible goals: satisfying strict regulatory requirements while protecting user privacy. Platforms obtain necessary compliance confirmations, users maintain data sovereignty, and the modular nature of zkKYC allows platforms to configure exactly the credentials they need for their specific use cases.

More importantly, this "verify once, use across multiple platforms" model significantly improves user experience, laying the foundation for Web3 ecosystem scalability.

2. Pain Point Two: How to Prevent Bot and Sybil Attacks?

The Fraud Threat Background in Web3 Ecosystems

Web3's decentralized and permissionless nature makes it vulnerable to automated attacks. Sybil attacks, where malicious actors create multiple fake identities, pose significant threats to platform integrity. These attacks can manipulate governance votes, drain incentive pools, distort market signals, and undermine user trust in voting systems, social media platforms, airdrop events, games, and charitable donations.

Technical Solution: MeID "One Face, One Identity"

zkMe's MeID (Anti-Sybil Suite) implements a revolutionary "One Face, One DID" concept that proves users are real and unique individuals while fully protecting their privacy. The system addresses critical challenges in decentralized identity management, including identity cloning, scalability, and sybil resistance.

Key Features:

- Proof of Personhood: Verifies that each user is a unique individual, preventing bot and sybil attacks

- Private-by-Design: Protects user privacy with full homomorphic encryption

- Instant Check: Provides quick verification of accuracy and effectiveness

- Reusable: One-time verification enables repeated use across platforms

Application Scenario: Impossible Finance's Comprehensive Anti-Fraud System

Impossible Finance demonstrates the power of combining multiple zkKYC components. Beyond using zkPoC and AMLMe for identity verification, the platform implements MeID's anti-sybil protection to ensure fair participation in its IDO launchpad and governance mechanisms.

As a platform focusing on providing "high-quality, fair, and accessible early-stage investment opportunities," Impossible Finance's fair allocation mechanisms and low entry barriers made it essential to prevent sybil attacks from gaming token distributions. The MeID integration ensures that each participant represents a genuine individual, protecting the platform's commitment to equitable access while maintaining robust security.This comprehensive approach prevents abusive behavior, establishes secure one-person-one-vote governance models, and ensures fair reward systems within the DeFi ecosystem.

3. Pain Point Three: How to Meet High-End Investment Product Regulatory Requirements?

Regulatory Challenges in Accredited Investor Verification

For businesses issuing unregistered securities under Regulation D and Regulation S exemptions, verifying accredited investor status is a legal necessity. Traditional verification processes require collecting and storing sensitive financial documents, exposing businesses to data breach risks, regulatory scrutiny, and operational inefficiencies.

Innovation Breakthrough: zkPoAI Within zkKYC Suite

zkMe's zkPoAI (Proof of Accredited Investor) is a key component of the zkKYC Compliance Suite that leverages zero-knowledge cryptographic technology and Reclaim's zkTLS technology to verify accredited investor status without accessing sensitive financial information. This privacy-preserving solution enables platforms to comply with securities regulations while maintaining Web3's decentralized principles.

Core Capabilities:

- Zero-Knowledge Verification: Proves income thresholds without revealing specific financial details

- Reusable Credentials: Cross-platform verification reduces repeated documentation requirements

- Client-Side Processing: All sensitive information verified on user devices through cryptographic commitments

- Regulatory Compliance: Meets Regulation D and S requirements for accredited investor verification

Pioneer Cases: Advanced Compliance Implementation

Hinkal Protocol: This privacy-focused Web3 platform enabling anonymous on-chain transactions across Ethereum and major EVM-compatible blockchains uses zkPoC, AMLMe, and Accredited Investor verification. Hinkal's implementation allows qualified investors to access exclusive opportunities within its privacy pools while maintaining compliance with securities regulations. The platform has processed over $250 million in trading volume while preserving user privacy.

RAAC: As a decentralized lending and borrowing ecosystem focused on tokenized Real World Assets, RAAC leverages zkPoAI to verify accredited investor status for participation in tokenized real estate, gold, and other stable asset investments. The platform's mission to "widen participation in tokenized Real World Assets" requires sophisticated verification to ensure only qualified investors access regulated investment products while maintaining privacy and decentralization.

Industry leaders including Plume Network, Midnight, and Digishares have committed to leveraging zkPoAI as core compliance infrastructure, recognizing its ability to scale RWA solutions while maintaining highest privacy and regulatory standards.

4. Pain Point Four: How to Conduct Real-Time Transaction Risk Monitoring?

Risk Management Requirements

As Web3 platforms attract institutional adoption, real-time transaction monitoring becomes crucial for regulatory compliance and risk management. Know Your Transaction (KYT) monitoring helps platforms detect suspicious activities, ensure AML compliance, and maintain regulatory standing across multiple jurisdictions.

zkMe's KYT Solution Within zkKYC Suite

KYT (Know Your Transaction) is an integral component of zkMe's zkKYC Compliance Suite, providing comprehensive on-chain transaction monitoring capabilities that identify and prevent money laundering, terrorist financing, and other illicit activities while maintaining user privacy.

Client Applications: SOON Network Implementation

SOON Network: This innovative Layer 2 modular Rollup solution combining Solana's SVM execution capabilities with Ethereum ecosystem interoperability uses zkPoC and AMLMe from zkKYC suite for comprehensive compliance. With over 30,000 TPS capacity and support for multiple blockchain integrations, SOON Network has processed over 27 million transactions while supporting more than 1.4 million active addresses.

The platform's hybrid execution model and multi-chain architecture require sophisticated compliance infrastructure to maintain regulatory standing across its expanding ecosystem, making zkKYC's modular approach ideal for its scalable, interoperable Web3 infrastructure vision.

The Transformation Path from Pain Points to Value

The future of Web3 depends on solutions that bridge the gap between innovation and regulation. zkMe's diverse client portfolio across DeFi, gaming, payments, and investment platforms demonstrates that this bridge is not only possible but essential for the next phase of Web3 mainstream adoption.

About zkMe

⭐ zkMe builds web3 protocols and infrastructure for compliant, self-sovereign, and private verification of user credentials. The only web3-native solution for dApps to fulfill user due diligence (KYC) in zero-knowledge natively onchain, without compromises on the decentralization & privacy ethos of web3.

🔖 Use Cases: zkKYC, zk Credit Score, zk GPS Geoblocking, zk Investor Accreditation, Onchain AML, Anti-Bot/Sybil Protection.

🚀Trusted by over 80 projects and with over 1.5 million user credentials, backed by Multicoin Capital, OKX Ventures, Robot Ventures and more. zkMe is the leading onchain compliance provider.

For more information, follow the links below:

Website | Twitter | Discord | Telegram | Telegram Mini app |