The Hidden Costs You're Paying

Are you truly aware of what your business is paying for identity verification?

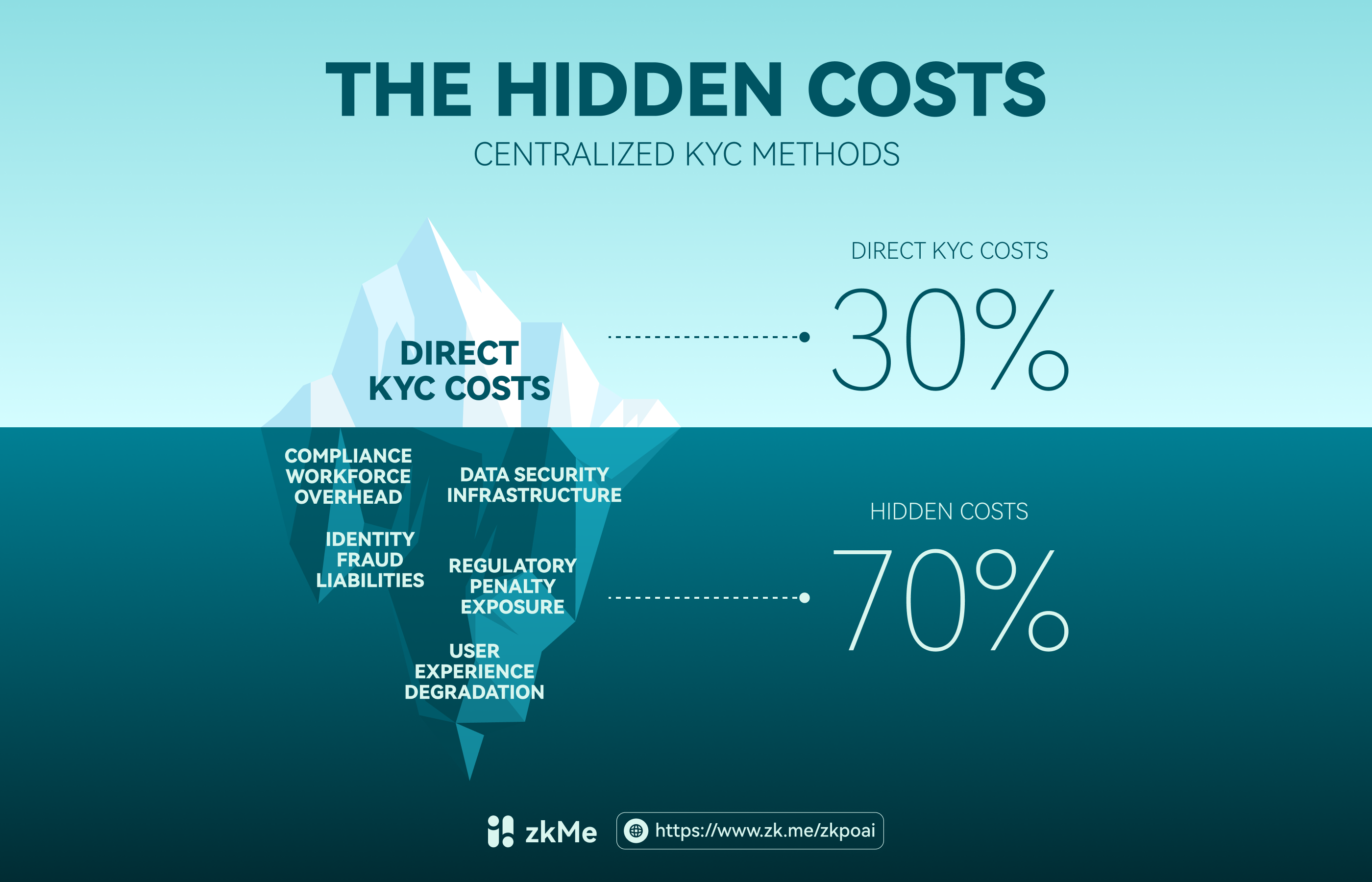

While you track direct KYC costs, the hidden expenses are silently draining your resources and compromising user security. In today's Web3 landscape, identity verification represents far more than a monetary expense—it embodies a complex ecosystem of hidden costs, privacy trade-offs, and security vulnerabilities affecting both businesses and users.

The Hidden Operational Toll on Businesses

Centralized KYC methods create significant financial and operational burdens that many organizations fail to recognize until they've accumulated to critical levels.

Conventional Know Your Customer (KYC) procedures demand substantial workforce allocation. Compliance officers, risk management teams, and customer service representatives invest countless hours processing identity documents and conducting background checks. This resource-intensive approach leads to higher staffing costs, prolonged turnaround times, and operational inefficiencies that scale with business growth.

Failure to adhere to global data protection regulations can result in devastating financial penalties. In 2024 alone, identity fraud cost businesses significantly. American adults lost $47 billion to identity fraud and scams, an increase of $4 billion over 2023. The total reported fraud losses reached $125 billion, highlighting the growing impact of identity fraud. Companies struggling with compliance processes frequently face data inaccuracies and inconsistent reporting across verification systems, exposing themselves to multi-million-dollar fines for violations of GDPR, AML/KYC, and other regulations.Without robust identity management systems, businesses face elevated fraud-related losses from account takeovers, payment fraud, unauthorized transactions, and synthetic identity exploitation. These security gaps collectively expose organizations to financial theft and reputational harm that can take years to recover from.

The Privacy Price Tag for Users

While businesses shoulder operational costs, users pay a different but equally significant price—with their personal data and privacy.

Traditional identity verification typically requires users to share extensive personal information with centralized databases and multiple third parties. This creates a persistent privacy risk as sensitive data moves through various verification systems.

Payment platforms like Stripe collect and process an extensive range of personal data, including biometric identifiers, government-issued ID documents, transaction histories, and device identifiers. While these systems enhance security, they require users to surrender privacy as the cost of participation in digital economies.

The reliance on centralized identity verification means users effectively "pay" with their privacy. Their personal information is stored in multiple databases, processed by various entities, shared across compliance networks, and vulnerable to breaches and unauthorized access.

Real-World Identity Vulnerabilities in Crypto

The theoretical costs of inadequate identity management become painfully concrete when examining actual fraud cases in the cryptocurrency space.

The California Department of Financial Protection and Innovation (DFPI) maintains a comprehensive Crypto Scam Tracker documenting numerous instances of identity theft, phishing attacks, and fraudulent platforms. Victims have suffered significant cryptocurrency losses through interactions with fraudulent platforms including Bitnice, Moon X Beast, X-presale.io, and Bit-jet.com, often after being manipulated into sharing personal information or credentials.

"Pig Butchering" scams have become increasingly prevalent. These sophisticated social engineering schemes involve scammers building trust over extended periods via social media before convincing victims to transfer crypto assets to fake investment platforms. Additional "fees" or "payments" are requested to withdraw funds that never materialize, while personal information collected during the process enables further exploitation.

Crypto space has also seen a surge in impersonation scams, including fake investment firms like SAXO Group and individuals posing as experienced advisors. Losses range from thousands to hundreds of thousands of dollars, facilitated by victims sharing sensitive personal data and wallet access information.

In particularly severe cases, victims have provided government-issued IDs and other personal details to fraudulent actors, resulting in comprehensive wallet hacks and complete asset theft.

Identity Without Compromise: How zkMe Reduces Costs While Protecting Privacy

In the face of these mounting challenges, zkMe has pioneered a revolutionary approach to identity verification through its zkKYC solution. By leveraging cutting-edge zero-knowledge proof (ZKP) technology, zkMe bridges the seemingly contradictory demands of regulatory compliance and privacy preservation in the Web3 ecosystem.

Cost Reduction Through Decentralization

Unlike traditional KYC providers that maintain expensive centralized databases requiring constant security upgrades, zkMe's fully decentralized architecture eliminates these overhead costs. Businesses no longer need to invest in secure storage infrastructure for sensitive user data because zkKYC never requires them to handle or store raw personal information in the first place. Traditional credential verification methods come with numerous risks including database breaches, unsecured front ends, and even potential misuse by employees. zkMe's patent-pending technology minimizes liability through decentralization, fundamentally changing the cost structure of compliance and reducing both direct expenses and liability risks.

Zero-Knowledge Compliance Without Privacy Compromise

zkMe's zkKYC automates compliance procedures while preserving user privacy through its innovative zero-knowledge approach. Businesses can verify that users meet regulatory requirements—such as age verification, jurisdiction checks, and AML screening—without ever seeing the underlying personal data. This automation dramatically reduces the operational burden on compliance teams while simultaneously minimizing human error in verification processes.

Fraud Prevention Through Verified Identity

The zkKYC suite includes robust anti-sybil and anti-bot measures that verify each user represents a unique individual without compromising anonymity. By implementing Proof-of-Personhood verification, businesses can effectively combat the sophisticated fraud schemes described earlier, such as "pig butchering" scams and impersonation attacks, without forcing users to expose sensitive personal information to potential attackers.

Enhanced User Experience Through Reusable Credentials

One of zkMe's most transformative innovations is the implementation of reusable credentials. With zkKYC, once users complete the verification process, they can leverage their credentials across multiple partnered services without undergoing repetitive KYC procedures. This omni-chain scalability means that verified credentials work across almost every blockchain ecosystem. The interoperability not only improves user experience but also distributes verification costs across the ecosystem, making compliance more economical for individual businesses while providing users with the convenience of a single verification process.

Real-World Business Impact

The real-world impact of zkMe's zkKYC solution can be seen through successful implementations across various Web3 platforms. Leading Web3 platforms including Tenzro, Impossible Finance, StationX, Hinkal and Xion Global have experienced significant benefits from integrating zkKYC into their operations:

- Reduced operational burden through automated compliance processes

- Streamlined user onboarding while maintaining privacy

- Enhanced security measures preventing fraud and unauthorized access

- Improved user satisfaction due to privacy preservation and simplified verification

- Successful navigation of complex regulatory requirements across global markets

In an environment where identity fraud costs businesses billions annually, zkMe's zkKYC offers a transformative approach that not only addresses the hidden costs highlighted earlier, but fundamentally reimagines how identity verification can work in the Web3 ecosystem—preserving privacy, enhancing security, and reducing costs simultaneously.

About zkMe

⭐ zkMe builds web3 protocols and infrastructure for compliant, self-sovereign, and private verification of user credentials. The only web3-native solution for dApps to fulfill user due diligence (KYC) in zero-knowledge natively onchain, without compromises on the decentralization & privacy ethos of web3.

🔖 Use Cases: zkKYC, zk Credit Score, zk GPS Geoblocking, zk Investor Accreditation, Onchain AML, Anti-Bot/Sybil Protection.

🚀Trusted by over 80 projects and with over 1.5 million user credentials, backed by Multicoin Capital, OKX Ventures, Robot Ventures and more. zkMe is the leading onchain compliance provider.

For more information, follow the links below:

Website | Twitter | Discord | Telegram | Telegram Mini app |