Imagine a place where you could invest in the outcome of future events, not just companies. Will a specific candidate win the next election? Will a blockbuster movie exceed box office expectations? This is the world of prediction markets, a rapidly growing sector that is transforming how we forecast the future.

In simple terms, a prediction market is a platform where people can buy and sell shares in the outcome of an event. For any given event, there are shares for "Yes" and "No". If you believe an event will happen, you buy "Yes" shares. If you think it won't, you buy "No" shares. The prices of these shares, which range from 0 to 1, reflect the market's collective belief in the probability of the event occurring. A "Yes" share trading at $0.70 suggests a 70% chance of that outcome happening.

What makes prediction markets truly dynamic is that these shares are tradable like tokens or stocks. This feature introduces two powerful concepts:

- Dynamic Odds and Early Exits: Unlike traditional betting where your odds are locked in, prediction markets are fluid. If you buy a "Yes" share early at $0.20 and new information makes that outcome more likely, the price might jump to $0.60. You can sell your share for a profit long before the event concludes. Conversely, if you made a bet that now looks unlikely to pay off, you can sell your shares at a lower price to cut your losses. This eliminates the problem in traditional betting where latecomers with more information have an unfair advantage.

- Wisdom of the Crowd: The constantly shifting prices aggregate the dispersed knowledge and opinions of thousands of participants in real-time. This is why prediction markets have often proven to be more accurate than traditional polls or expert analyses. The Iowa Electronic Markets, a pioneering platform launched in 1988, has famously demonstrated this by consistently predicting the results of U.S. presidential elections with greater accuracy than many established polling organizations [1].

Fueled by this power, the prediction market landscape has seen explosive growth. Monthly trading volumes have skyrocketed by an incredible 130-fold since the beginning of 2024 [2], with platforms like Polymarket and Kalshi attracting billions of dollars in trading volume [3, 4]. But this rapid ascent has brought a fundamental conflict to the forefront: the clash between the decentralized, privacy-focused ethos of Web3 and the ever-present demands of regulatory compliance.

The Compliance Dilemma in a Decentralized World

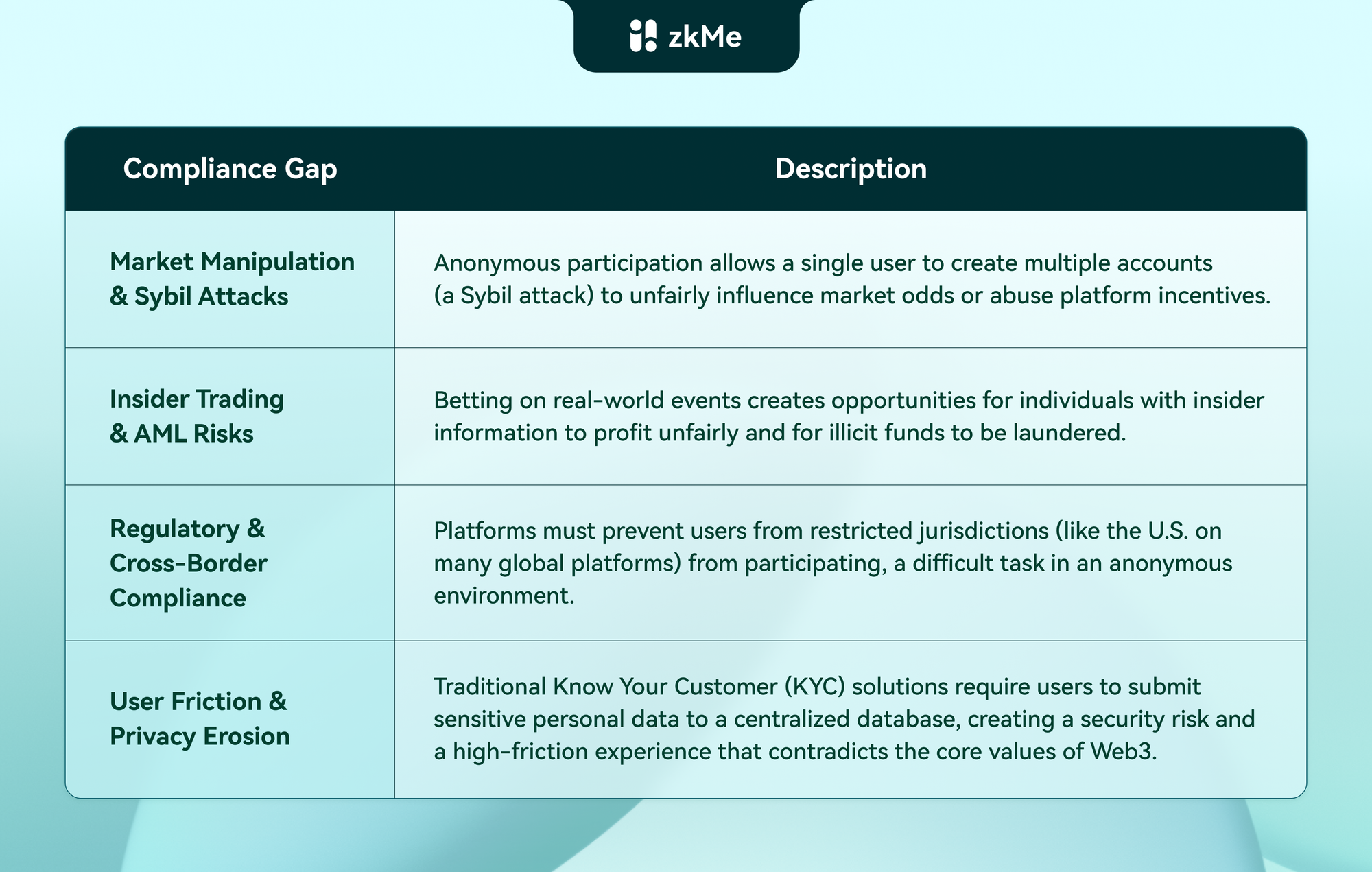

The rise of blockchain technology has enabled a new generation of decentralized prediction markets (DPMs). However, their core features, anonymity and open access, create significant compliance gaps that hinder mainstream adoption and attract regulatory scrutiny.

This friction is not theoretical. Polymarket, a leading crypto prediction market, has had to geoblock U.S. users to comply with regulations, while its U.S. based counterpart, Polymarket US, requires full KYC, creating a fragmented user experience [5]. This highlights the central tension: how can a platform remain decentralized and privacy-oriented while also adhering to the identity verification rules of legacy financial systems?

Enter zkMe: A Regulatory Assurance Layer

This is precisely where zkMe, a decentralized identity verification protocol, enters the conversation. zkMe is not a traditional KYC provider that collects and stores user data. Instead, it acts as a "Regulatory Assurance Layer", allowing platforms to prove compliance without ever taking custody of sensitive personal information.

It achieves this using one of the most powerful cryptographic innovations of recent years: Zero-Knowledge Proofs (ZKPs). A ZKP allows a user to prove a statement is true without revealing the underlying data. It’s like proving you are old enough to drink without showing your ID card. With zkMe, a user can generate a cryptographic proof on their own device to verify specific attributes, for example, "I am not a resident of the USA", or "I have completed AML screening" without ever sharing their name, location, or government ID with the prediction market platform.

How zkMe Can Revolutionize Prediction Markets

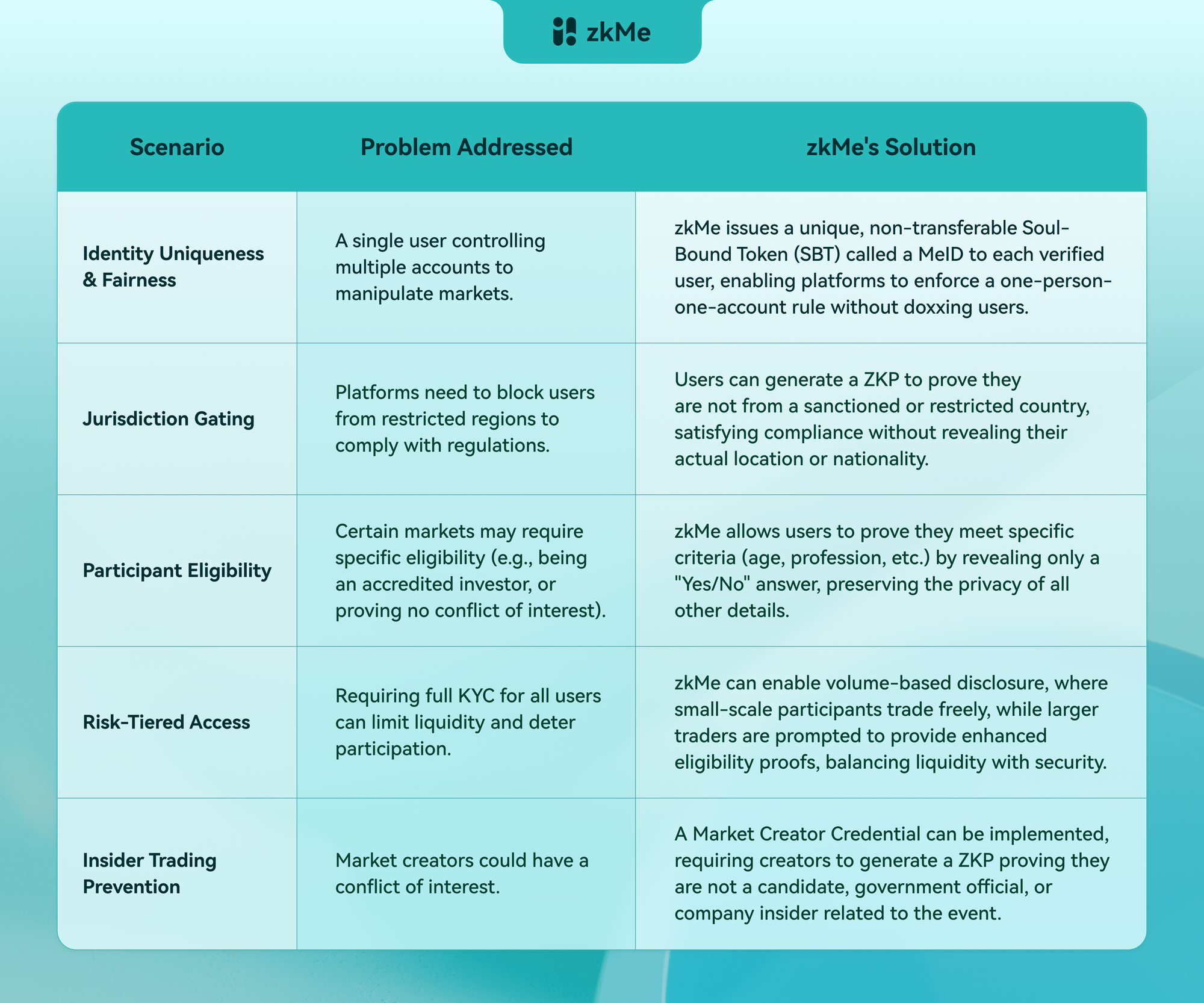

By integrating zkMe, prediction markets can resolve their compliance dilemma and unlock new capabilities, achieving a state of being simultaneously compliant, private, and decentralized.

The Future of Forecasting: Private, Compliant, and Decentralized

The explosive growth of prediction markets shows a clear and growing demand for decentralized forecasting tools. However, for these markets to achieve mainstream adoption and long-term sustainability, they must solve the regulatory puzzle. Forcing users into the old world of centralized data collection is not the answer.

Solutions like zkMe offer a compelling vision for the future; a future where platforms can build trust with both users and regulators. By integrating a privacy-first regulatory assurance layer, prediction markets can finally move beyond the persistent conflict between compliance and decentralization, unlocking a new era of growth and establishing themselves as a legitimate and powerful tool for forecasting our collective future.

References

[1] Investopedia. (2025, December 8). Prediction Markets Explained: Types, Uses, and Real-World Examples. https://www.investopedia.com/terms/p/prediction-market.asp

[2] The Defiant. (2025, December 16). Prediction Market Monthly Volumes Grew 130x Since 2024: Keyrock, Dune. https://thedefiant.io/news/research-and-opinion/prediction-market-2025-growth-report-keyrock-dune

[3] Medium. (2025, November 15). Prediction Markets 2025: Polymarket, Kalshi, and the Next Big Rotation. https://medium.com/@monolith.vc/prediction-markets-2025-polymarket-kalshi-and-the-next-big-rotation-c00f1ba35d13

[4] Reuters. (2025, December 2). Kalshi's valuation doubles on strong interest in prediction markets. https://www.reuters.com/business/kalshi-valued-11-billion-latest-financing-round-2025-12-02/

[5] OneSafe Blog. (2024, October 22). How Polymarket is Shaping Crypto Betting and Regulatory Compliance. https://www.onesafe.io/blog/polymarket-crypto-betting-regulatory-compliance