The landscape of cryptocurrency regulation is about to undergo a seismic shift. Starting January 1, 2026, the United Kingdom will implement the Cryptoasset Reporting Framework (CARF), fundamentally transforming how crypto businesses operate and setting a precedent that could reshape global digital asset compliance.

The UK CARF Act: A Major Regulatory Shift

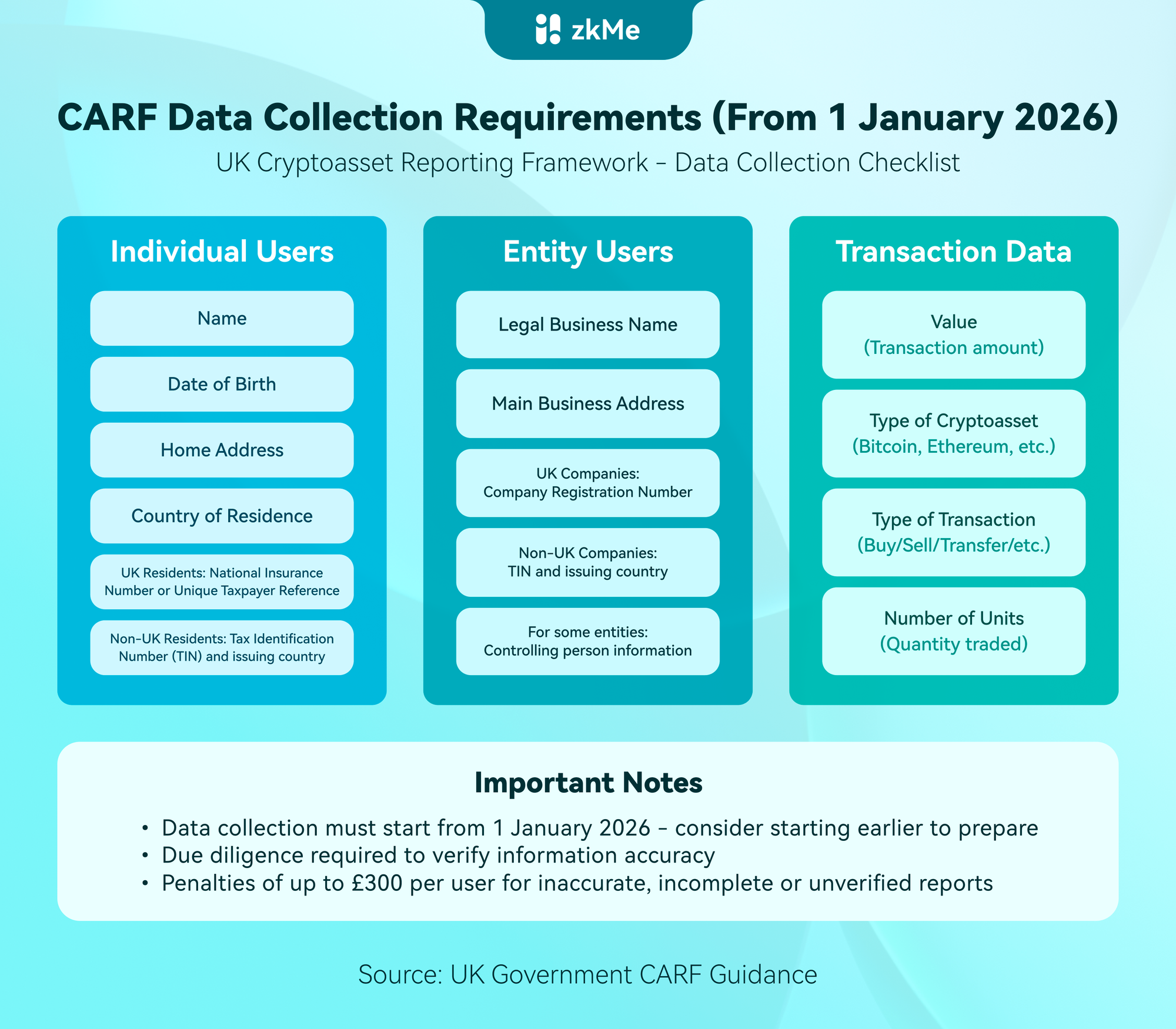

Unprecedented Data Collection Requirements

Under the new UK CARF (Cryptoasset Reporting Framework) legislation, all companies providing cryptoasset services in the UK must collect comprehensive data including:For Individual Users:

- Name and date of birth

- Home address and country of residence

- For UK residents: National Insurance number or Unique Taxpayer Reference

- For non-UK residents: Tax Identification Number and the country where it was issued

If a user cannot be issued a TIN (for example, because their country does not issue TINs), you do not need to provide one.For Entity Users (Companies, Partnerships, Trusts, Charities):

- Legal business name and main business address

- For UK companies: Company registration number

- For non-UK companies: Tax Identification Number and the country where it was issued

- For some entities: Information about their controlling persons

For Each Transaction:

- Value

- Type of cryptoasset

- Type of transaction

- Number of units

Companies must collect all data from January 1, 2026 onwards and verify accuracy through due diligence procedures. The UK is implementing the OECD's Cryptoasset Reporting Framework (CARF) while extending it to include domestic reporting requirements.

Broad Coverage Requirements

The regulation requires companies providing cryptoasset services in the UK to collect data on cryptoasset transactions for users in the UK and other CARF countries. This represents a significant expansion in transaction monitoring and reporting requirements for crypto service providers.There will be penalties of up to £300 per user for inaccurate, incomplete, or unverified reports. This represents a zero-tolerance approach to compliance that signals the UK's commitment to regulatory oversight in crypto space.

Global Ripple Effect: A New Era Begins

As one of the world's leading financial centers, the UK's regulatory approach to crypto assets may influence other jurisdictions. Many industry observers expect that other countries could follow similar paths, potentially leading to more widespread KYC requirements for cryptocurrency transactions globally. While each country will develop its own regulatory framework, the UK's CARF implementation represents a significant step toward integrating crypto assets into traditional financial oversight systems.

The Question Every Web3 Platform Will Face in 2026

Starting 2026, UK's CARF Act requires crypto platforms to collect and store comprehensive user data—names, addresses, tax IDs, and transaction histories. This creates a fundamental conflict with Web3's core promise of privacy and decentralization. Traditional KYC forces an impossible choice: either compromise on user privacy or risk regulatory penalties. But what if this trade-off was based on outdated assumptions?With zero-knowledge technology, zkMe offers a comprehensive suite of zero-knowledge credentials specifically designed to address CARF requirements:

zkMe's CARF Compliance Suite

- zkTIN (Tax Identification Number) - Secure verification without storing sensitive data, leveraging Reclaim's zkTLS technology for secure transport-layer verification

- For UK residents: including UTR (Unique Taxpayer Reference) and NHS number (National Insurance Number)

- For non-UK residents: processes country-specific tax identification requirements

- zkKYC - Verify user identities, addresses, and residency status while maintaining complete data privacy, enabling platforms to confirm user information without ever handling raw personal data.

- KYT (Know Your Transaction) - Monitor transaction values, types, and units as required by CARF while preserving user privacy through zero-knowledge verification of transaction details.

- zkPoC (Proof of Citizenship) - Validate citizenship and residency status without exposing underlying personal information, critical for jurisdictional compliance.

- MeID - Ensure each user is a unique real person, preventing duplicate accounts while protecting biometric data through homomorphic encryption.

Our approach helps satisfy regulatory requirements while preserving user privacy—potentially turning compliance obligations into competitive advantages.

Beyond Traditional Trade-offs: The Strategic Business Imperative

The 2026 deadline isn't just about compliance—it's about positioning.While some platforms scramble to build traditional KYC infrastructure, forward-thinking crypto enterprises are already using zkMe to transform compliance from a burden into a powerful market differentiator. As regulations like the UK's CARF and the EU's MiCA reshape the landscape, businesses that leverage privacy-preserving compliance will gain significant competitive advantages in user acquisition and trust.The strategic question isn't whether more regulation is coming—it's whether your platform will lead or follow in the privacy-first compliance revolution.

About zkMe

⭐ zkMe builds web3 protocols and infrastructure for compliant, self-sovereign, and private verification of user credentials. The only web3-native solution for dApps to fulfill user due diligence (KYC) in zero-knowledge natively onchain, without compromises on the decentralization & privacy ethos of web3.

🔖 Use Cases: zkKYC, zk Credit Score, zk GPS Geoblocking, zk Investor Accreditation, Onchain AML, Anti-Bot/Sybil Protection.

🚀Trusted by over 80 projects and with over 1.5 million user credentials, backed by Multicoin Capital, OKX Ventures, Robot Ventures and more. zkMe is the leading onchain compliance provider.

For more information, follow the links below:

Website | Twitter | Discord | Telegram | Telegram Mini app |