Tokenized U.S. stocks represent one of the fastest-growing frontiers in the Web3 financial ecosystem. Several emerging platforms are enabling users worldwide to trade fractional shares of real stocks on blockchain networks. However, a significant and under-discussed issue remains: many of these platforms implement insufficient KYC verification for users during on-chain transactions.

This lack of proper identity verification in decentralized trading activities introduces serious security risks and safety concerns that have been widely recognized as threats to users and the broader ecosystem.

The Hidden Danger: Operating Without KYC

Tokenized stocks are digital tokens representing ownership in real-world shares or equities backed 1:1 by custodial assets. Despite blockchain’s innovation, these tokens are still regulated securities under U.S. law and elsewhere. Without proper KYC, tokenized stock platforms expose users to:

- Fraud and theft risks, as anonymous accounts can facilitate scams or unauthorized trading.

- Money laundering and illicit finance activities, undermining regulatory compliance and investor protection.

- Regulatory enforcement risks, as unverified trading platforms risk sanctions and user penalties from authorities like the SEC.

- Lack of recourse for users if problems arise.

In traditional finance, KYC is foundational for securing markets. The same rigor must extend to tokenized equity markets to ensure compliance and user trust.

Why Traditional KYC Falls Short in Web3

While the need for KYC is clear, traditional centralized KYC solutions contradict the core principles of Web3:

- Privacy violations: Centralized databases store sensitive personal information

- Data breach risks: Single points of failure expose user data to hackers

- Decentralization compromise: Centralized KYC creates dependency on third parties

- User experience friction: Repetitive verification processes across platforms

- Geographic limitations: Inconsistent requirements across jurisdictions

Enter zkKYC: The Privacy-Preserving Solution

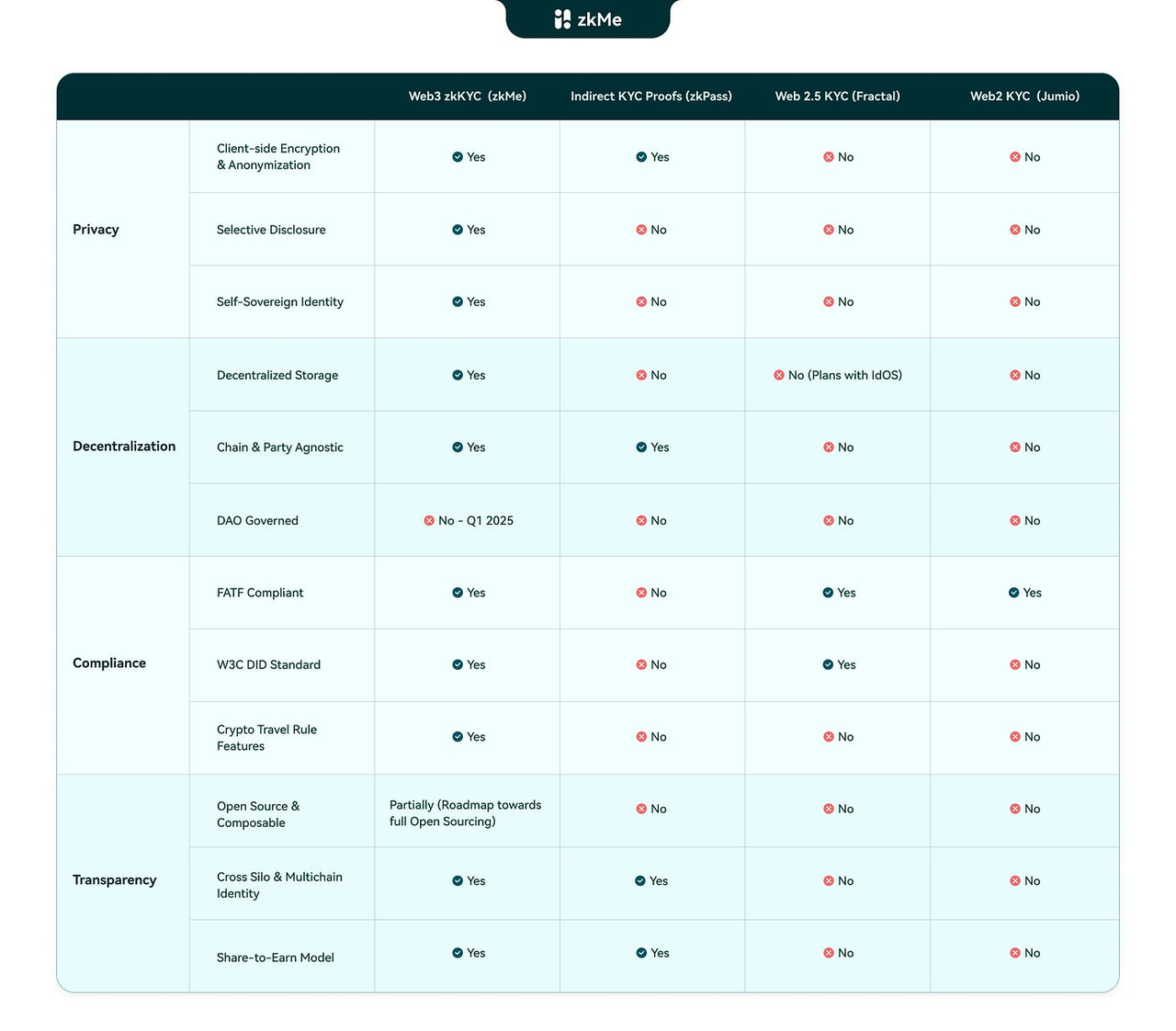

zkMe's zkKYC represents a revolutionary approach that addresses all these challenges while maintaining the decentralized ethos of Web3. As the world's only FATF-compliant KYC provider offering a fully decentralized solution, zkMe has already processed over 1.3 million verifications across 25 blockchain networks.

How zkKYC Works

zkKYC leverages Zero-Knowledge Proof (ZKP) technology to enable identity verification without exposing sensitive personal data:

- Private Verification: Users prove their identity and eligibility without revealing personal information

- Decentralized Processing: No centralized storage of sensitive data

- Reusable Credentials: One-time verification enables access across multiple platforms

- Regulatory Compliance: Meets FATF, AML, and global KYC requirements

- Blockchain Agnostic: Works seamlessly across all major blockchain networks

Key Features for Tokenized Stock Platforms

Proof of Citizenship (zkPoC)

- Verify jurisdictional eligibility without revealing exact location

- Ensure compliance with regional securities laws

- Enable global access while respecting local regulations

Proof of Accredited Investor (zkPoAI)

- Validate investor qualification for restricted securities

- Comply with Regulation D and Regulation S requirements

- Protect high-net-worth individual privacy

AML Screening (AMLMe)

- Screen against global sanctions and PEP lists

- Monitor adverse media in real-time

- Prevent money laundering and terrorist financing

Anti-Sybil Protection (MeID)

- Ensure "One Face, One DID" to prevent fake accounts

- Eliminate bot activities and market manipulation

- Maintain market integrity through verified unique identities

By embedding zkKYC, tokenized equity platforms can professionalize this nascent market, protect user interests, and unlock institutional partnerships that expect strong compliance frameworks.

Conclusion: Securing the Future of Tokenized Stocks with zkKYC

The explosive growth of tokenized U.S. stocks on blockchain platforms—while promising greater accessibility and efficiency—cannot come at the cost of security and regulatory compliance. Current projects without KYC expose users to outsized risks.

zkKYC is the breakthrough technology needed to bring secure, privacy-first, and compliant identity verification to tokenized stock markets. As regulators reaffirm that tokenized stocks remain securities subject to existing laws, platforms must prioritize KYC to ensure sustainable user protection and legitimacy.

Market participants, developers, and users should advocate for and adopt zkKYC solutions now to safeguard this exciting new asset class and foster a healthier Web3 financial ecosystem.

Conclusion: Securing the Future of Tokenized Stocks with zkKYC

Tokenized stocks offer clear benefits. But without proper identity verification, these platforms operate in a regulatory gray area that becomes more dangerous as trading volumes grow.

The solution isn't complicated. Zero-knowledge KYC technology already exists and works. It protects user privacy while satisfying regulatory requirements—exactly what tokenized stock platforms need to operate safely at scale.

Early adopters of privacy-preserving KYC will likely gain competitive advantages as the regulatory environment clarifies. More importantly, they'll help ensure that tokenized finance develops into a legitimate, trusted part of the global financial system

About zkMe

⭐ zkMe builds web3 protocols and infrastructure for compliant, self-sovereign, and private verification of user credentials. The only web3-native solution for dApps to fulfill user due diligence (KYC) in zero-knowledge natively onchain, without compromises on the decentralization & privacy ethos of web3.

🔖 Use Cases: zkKYC, zk Credit Score, zk GPS Geoblocking, zk Investor Accreditation, Onchain AML, Anti-Bot/Sybil Protection.

🚀Trusted by over 80 projects and with over 1.5 million user credentials, backed by Multicoin Capital, OKX Ventures, Robot Ventures and more. zkMe is the leading onchain compliance provider.

For more information, follow the links below:

Website | Twitter | Discord | Telegram | Telegram Mini app |