Many crypto users and startups worry about "de-banking" and restrictive banking decisions. Banks and financial institutions often act cautiously — not out of ideology, but because they lack clear, privacy-preserving ways to evaluate risk. That same lack of transparent verification also makes onboarding and compliance awkward for crypto businesses and regulators.

The Root of the Misconception: Opaqueness on Both Sides

- Banks hold the data; they must protect it. Traditional financial institutions are conservative about sharing raw account data and are bound to compliance obligations.

- Crypto services and regulators need evidence. Exchanges, custodial wallets, token sales, and compliance teams often require proof of funds, residency, or account ownership — yet asking for screenshots or full statements risks privacy and fraud.

- Users are stuck in the middle. People must choose between oversharing sensitive data and failing to onboard or comply. That ambiguity fuels fear and slows adoption.

What's Missing: A Trustable, Privacy-Preserving Way to Prove Facts

For the crypto-banking ecosystem to operate smoothly and securely, we need:

- A way to prove wallet or identity legitimacy, or financial/account status. For example, "I control this bank account", "My account has a positive balance", or "I receive income above X".

- A method that respects user privacy, no oversharing of PII, no central storage of personal data.

- A mechanism that allows crypto businesses, financial institutions, regulators, and users to interact with confidence, striking a balance between compliance and decentralization.

Until now, that balance has been hard to find.

Enter zkMe: Privacy-First, Self-Sovereign Identity for Web3

zkMe is a privacy-first identity layer for Web3 that combines self-sovereign identity with zero-knowledge proofs. Its goal: let users selectively disclose verifiable facts to services and authorities, while retaining ownership of their data.

Key features relevant to individual verification:

- Selective disclosure: users share only the necessary truth-value (e.g., "Yes: account active"), not full documents.

- Local proof generation: proofs are created by the user's device or wallet, minimizing third-party data handling.

- Reusable verifiable credentials: once a fact is proven, the resulting credential can be used across services without repeating document uploads.

And when the fact to prove lives behind a standard HTTPS site (a bank portal, payroll provider, or government site), zkTLS is the tool that makes it possible — privately and verifiably.

zkTLS: A Bridge Between Web2 Data and Web3 Privacy

What zkTLS does

zkTLS enables an individual to access a standard HTTPS resource (for instance, their online bank statement or payroll portal) and generate a zero-knowledge proof that a specific attribute exists in that resource — without sharing the underlying page or sensitive values.

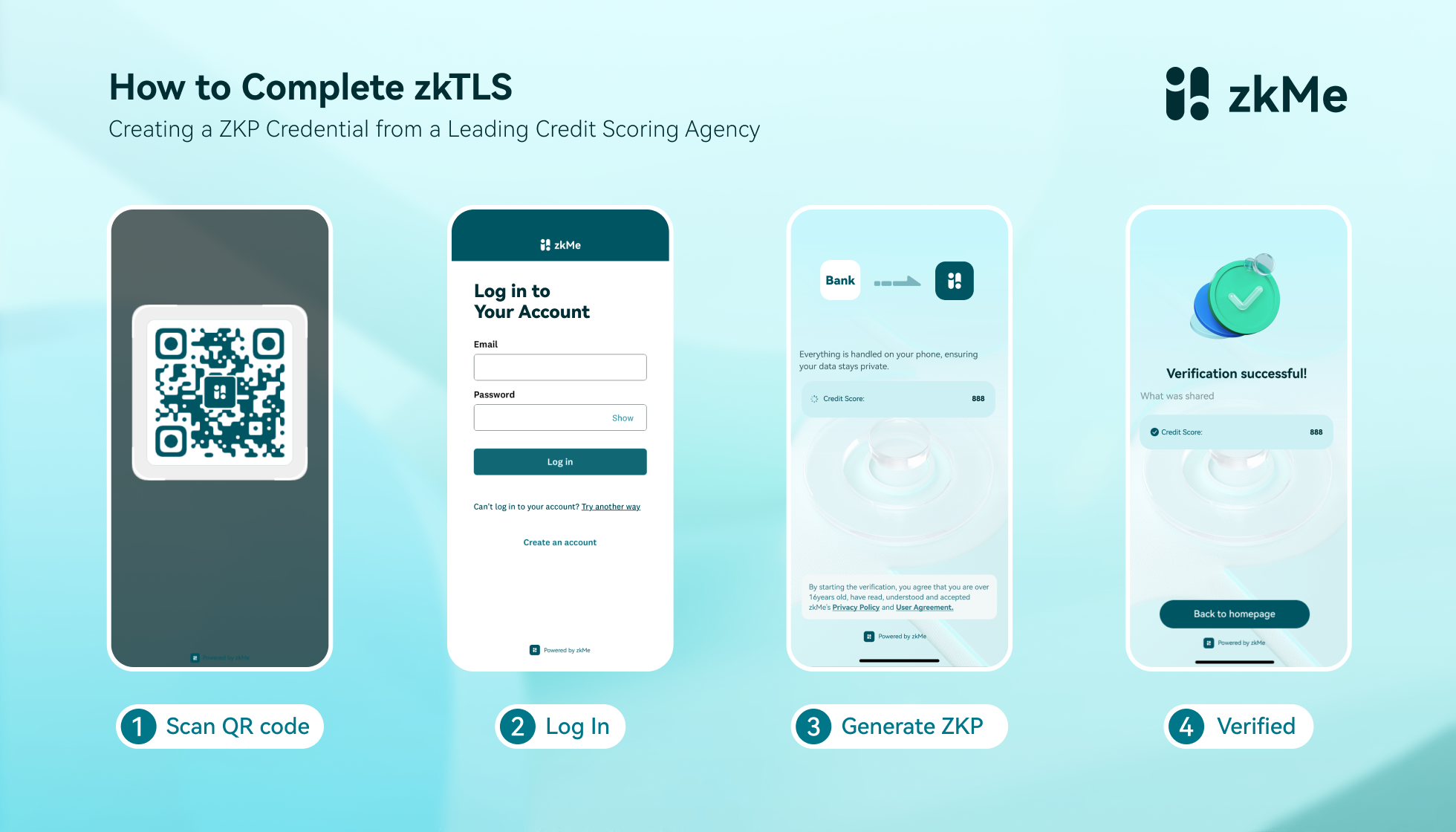

The user flow, simply explained

- A user opens their bank or payroll page via a local zkTLS-enabled client (wallet or app). The client observes the TLS session and the specific data elements the user wants to prove.

- zkTLS produces a compact cryptographic proof (a ZK-SNARK) that ties the asserted fact to a valid TLS response from the institution, without exporting raw statements.

- The user submits that proof to a verifier (an exchange, a KYC provider, a regulator, or a smart contract) to satisfy an onboarding or compliance requirement.

Because proofs are generated locally and contain no PII, users stay in control while verifiers get mathematically strong evidence.

Why it matters

- Privacy-preserving compliance: Users never leak raw personal or financial data. Only a "yes/no" proof is revealed.

- No backend integration required: Because zkTLS sits on the user's side and uses standard TLS, existing Web2 services don't need to change anything. This dramatically lowers friction for banks or institutions to adopt.

- Verifiable across chains and applications: The proofs generated by zkTLS integrate seamlessly with zkMe's credential system, meaning once verified, a user's credentials can be reused across Web3 services.

Why zkTLS Changes the Risk Model

By adopting zkMe + zkTLS, crypto projects, wallets, exchanges, and even traditional financial institutions can transform the way they evaluate risk and compliance:

- For crypto businesses: Onboarding becomes smoother and more scalable. Because banks or partners can receive valid cryptographic proofs rather than raw data, there's less friction, fewer regulatory headaches, and greater trust.

- For users: Personal data stays private. You no longer have to surrender sensitive documents or banking screenshots — you just provide cryptographic assurance.

- For banks and regulators: They gain access to verifiable, auditable proofs, but no unnecessary personal data. That reduces liability and risk while respecting privacy.

- For the entire ecosystem: A new bridge forms between Web2 and Web3 — one built on mathematical trust, not blind faith or centralized storage.

In short: zkTLS turns the "unknown risk", which often leads to blanket de-risking and debanking, into a transparent, verifiable, standardizable process.

Ready to unlock the power of a trustless, privacy-preserving compliance layer?

From Fear to Infrastructure

The crypto industry's debanking fears aren't borne of ideological suppression, they arise from uncertainty, lack of transparency, and a mismatch between legacy finance's risk model and Web3's decentralized paradigm.

But with zkMe (and its zkTLS protocol), there's a viable path forward: a privacy-first, trust-minimized identity and verification infrastructure that meets compliance, satisfies institutional risk standards, and keeps user data sovereign.

If Web3 is to scale and truly co-exist with traditional finance, tools like zkTLS aren't optional — they're essential.

Let's stop arguing over fear, and start building infrastructure that brings clarity, trust, and privacy back to crypto.

About zkMe

zkMe provides protocols and oracle infrastructure for the compliant, self-sovereign, and private verification of Identity and Asset Credentials.

It is the only decentralized solution capable of performing FATF-compliant CIP, KYC, KYB, and AML checks natively onchain, without compromising the decentralization and privacy ethos of Web3.

By combining zero-knowledge proofs with advanced encryption and cross-chain interoperability, zkMe enables verifiable identity and compliance data to remain entirely under the user's control. This ensures that sensitive information never leaves the user's device while maintaining regulatory-grade assurance for partners and protocols.