What Is Open Banking and Why It Matters for Modern Finance

Open Banking is a system that allows users to authorize access to their financial data by third party services. Instead of keeping financial data locked inside a single bank, Open Banking enables controlled data sharing across institutions.

For businesses, this model changes how financial verification works. Instead of relying on manual document uploads or repeated checks, platforms can access verified financial signals directly from trusted sources. This improves conversion rates, reduces fraud, and lowers compliance costs.

As regulators worldwide push for user data rights and portability, Open Banking is becoming a foundational layer of modern finance. For Web3 businesses that want to connect on chain activity with real world finance, Open Banking is no longer optional. It is essential.

Why Traditional Open Banking Falls Short for Web3

While Open Banking has made progress in traditional finance, its adoption in the Web3 industry remains difficult.

Most implementations rely on official bank APIs and centralized data aggregators. Access requires long approval cycles, regional coverage, and ongoing maintenance. For global Web3 platforms, this creates delays and fragmentation.

More importantly, traditional Open Banking is built around data sharing. Raw financial data is transmitted, stored, and processed by third parties. This increases privacy risk and compliance burden, which directly conflicts with Web3 values such as user sovereignty and minimal data exposure.

Web3 platforms rarely need full bank statements. What they need is simple:

- Does this user qualify?

- Can this transaction be trusted?

- Can this account be verified?

Traditional Open Banking was not designed for this verification first mindset. This is where zkMe introduces a new model.

zkMe zkOBS: A Unified Open Banking Verification Layer

zkMe is an identity and compliance protocol built for Web3. zkOBS stands for Zero Knowledge Open Banking Services.

zkOBS rethinks Open Banking from a verification perspective. Instead of moving financial data between institutions and platforms, zkOBS transforms financial data into zero knowledge proofs. These proofs confirm financial attributes without exposing the underlying data.

At the core of zkOBS is zkTLS. zkTLS allows zkMe to verify financial information directly from Web2 bank or brokerage web interfaces. As long as the data is accessible through an HTTPS secured webpage, zkOBS can generate cryptographic proof of data origin and integrity. No API access is required.

What is zkTLS - Unlocking Web2 Data for the Web3 World

This makes zkOBS a unified, API independent Open Banking verification layer designed for Web3 scale and privacy.

How zkOBS Works in Practice

zkOBS replaces data sharing with proof sharing. The process is simple.

- First, a user logs into a bank or financial platform through a standard HTTPS secured web session.

- Second, zkTLS proves that the session is authentic and that the data comes from the real institution. The data is not modified or fabricated.

- Third, zkOBS processes the data locally and generates a zero knowledge proof that confirms a specific financial attribute.

- Finally, the application verifies the proof. The raw financial data is never shared or stored by the application.

This process allows platforms to verify financial conditions without taking custody of sensitive data.

Core Financial Credentials Powered by zkOBS

zkOBS offers a set of ready to use financial credentials that match real business needs.

Proof of Credit Score

Verifies that a user meets a required credit score threshold. Useful for lending, payments, and financial access control.

Proof of Accredited Investor

Confirms that regulatory income or asset thresholds are satisfied. Ideal for private offerings, RWA, and tokenized securities.

Proof of Account Ownership

Proves control of a real bank or brokerage account. Supports source of funds checks without exposing account details.

Proof of Account Assets

Verifies total assets or net worth across multiple accounts. Designed for wealth management and institutional access.

Proof of Account Transactions

Confirms income stability or transaction behavior patterns without revealing individual transactions.

All credentials are user bound, reusable, and privacy preserving. They can be consumed on chain or off chain depending on the application.

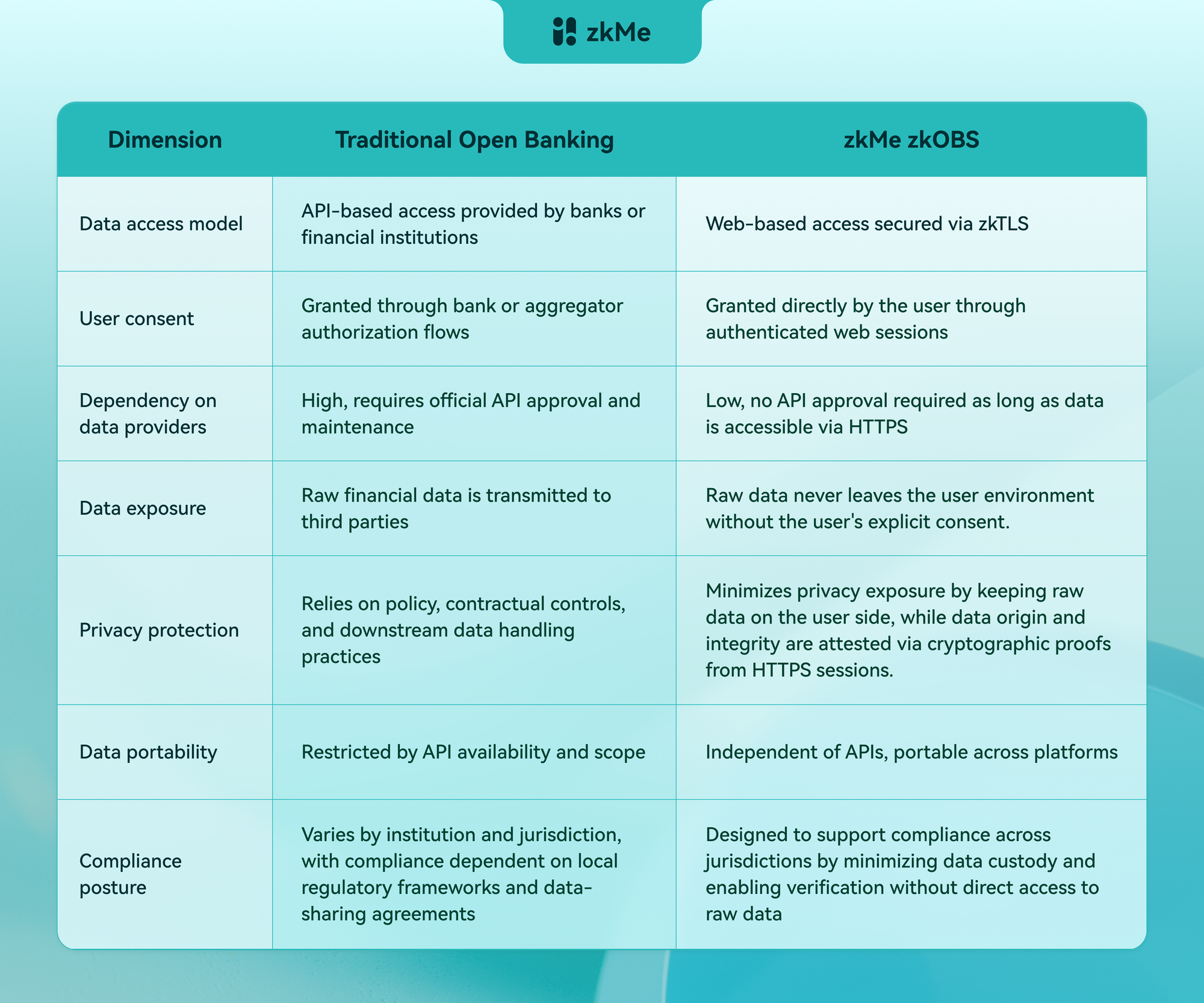

From Data Access to Verification. How zkOBS Redefines Open Banking

The difference between traditional Open Banking and zkOBS is best understood as a shift from data access to verification.

For Web3 businesses, this difference directly translates into faster integration, global reach, and stronger trust guarantees.

The Future of Open Banking Is Verification First

Open Banking is reshaping how financial data is accessed and used. However, for Web3, data access alone is not enough.

What Web3 needs is verification without exposure.

zkMe zkOBS delivers this by combining zkTLS with zero knowledge proofs. It transforms Web2 financial data into verifiable financial signals that can be safely used across on chain and off chain environments.

Ready to unleash the power of Zero-Knowledge Open Banking Service? Contact zkMe now!

As Web3 applications continue to intersect with real world finance, platforms that adopt verification first Open Banking will move faster, reduce risk, and earn user trust. zkOBS provides the infrastructure to make that transition possible.

About zkMe

zkMe provides protocols and oracle infrastructure for the compliant, self-sovereign, and private verification of Identity and Asset Credentials.

It is the only decentralized solution capable of performing FATF-compliant CIP, KYC, KYB, and AML checks natively onchain, without compromising the decentralization and privacy ethos of Web3.

By combining zero-knowledge proofs with advanced encryption and cross-chain interoperability, zkMe enables verifiable identity and compliance data to remain entirely under the user's control. This ensures that sensitive information never leaves the user's device while maintaining regulatory-grade assurance for partners and protocols.