The Accredited Investor Challenge in RWA Tokenization

Real-World Asset tokenization stands at the intersection of traditional finance and blockchain innovation, creating a multi-billion dollar opportunity for platforms that can successfully navigate the complex regulatory landscape.

For projects offering security tokens under Regulation D or Regulation S exemptions, verifying accredited investor status has become a critical compliance requirement. Traditional verification methods demand exposing sensitive financial data, creating friction for privacy-conscious users and contradicting Web3's core principles of data sovereignty and decentralization.

A Web3 native solution to this compliance dilemma is essential for platforms seeking to unlock the full potential of tokenized real-world assets.

The Compliance Conundrum of RWA Tokenization

The tokenization of Real-World Assets (RWA) refers to the process of converting tangible or intangible assets—such as real estate, commodities, or financial instruments—into digital tokens on a blockchain. This innovative approach unlocks liquidity, enhances transparency, and enables fractional ownership, making traditionally illiquid assets accessible to a broader range of investors. In the context of Web3, RWA tokenization holds immense potential to bridge traditional finance and decentralized ecosystems, fostering a more inclusive and efficient financial landscape.

However, the tokenization of RWA is subject to stringent regulatory oversight, particularly in jurisdictions like the United States.

The Securities Act of 1933, a cornerstone of U.S. securities law, governs the issuance and sale of securities to protect investors and maintain market integrity. Under this law, any offering of securities must either be registered with the Securities and Exchange Commission (SEC) or qualify for an exemption. For RWA tokenization projects, this often means navigating complex regulatory frameworks to ensure compliance.

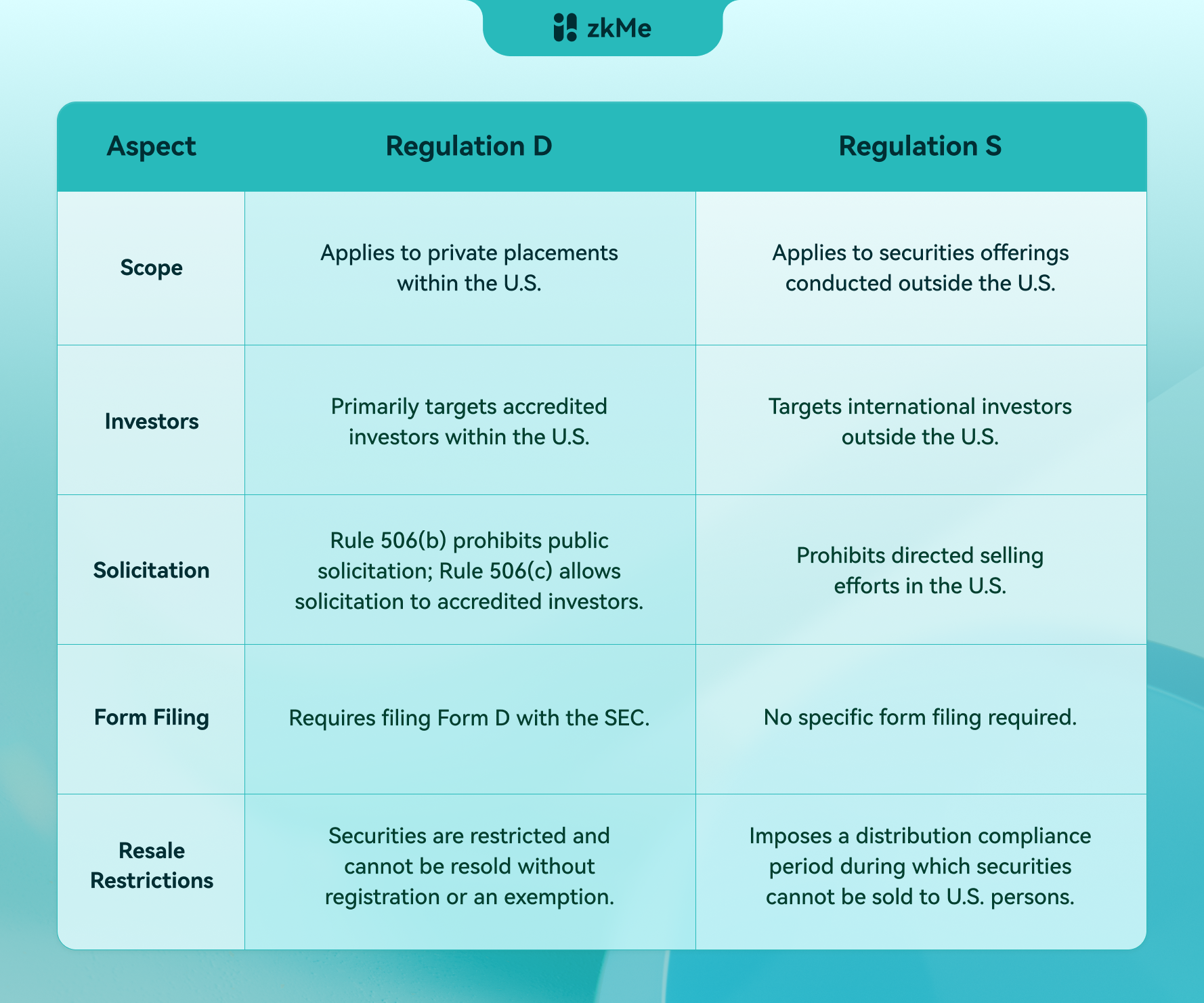

Two commonly utilized exemptions under the Securities Act are Regulation D (Reg D) and Regulation S (Reg S):

- Regulation D (Reg D): This exemption allows companies to raise capital through private offerings without registering with the SEC, provided they meet specific conditions. Under Rule 506(c) of Reg D, issuers can solicit investments publicly but must ensure that all participating investors are accredited investors. Accredited investors are individuals or entities that meet certain income or net worth thresholds, as defined by the SEC, to demonstrate their capacity to bear the risks of such investments.

- Regulation S (Reg S): This exemption applies to offerings made outside the United States. Securities issued under Reg S are not required to be registered with the SEC, provided they are sold exclusively to non-U.S. persons and meet specific conditions to prevent the securities from being resold to U.S. investors.

Sources:Securities and Exchange Commission (SEC)

Both exemptions impose strict requirements for verifying investor eligibility, particularly for accredited investors under Reg D. This verification process often involves collecting and reviewing sensitive financial information, such as income statements, tax returns, or net worth documentation. While these measures are essential for regulatory compliance, they pose significant challenges for RWA tokenization projects, especially those aiming to preserve user privacy and adhere to the decentralized ethos of Web3.

zkPoAI: Privacy-Preserving Accreditation for the Web3 Era

zkPoAI (Proof-of-Accredited-Investor) is a groundbreaking solution that enables RWA platforms to verify accredited investor status in a completely privacy-preserving manner. Powered by Zero-Knowledge Proofs (ZKPs), zkPoAI ensures compliance with regulations like Reg D without exposing sensitive financial or identity details.

Here’s how zkPoAI works:

- User-Initiated Verification: Users initiate income verification through a secure portal, where they authorize the system to retrieve relevant data from trusted sources.

- Zero-Knowledge Proof Generation: Instead of transmitting raw data, zkPoAI generates a cryptographic proof that confirms the user meets the income thresholds for accreditation.

- Privacy by Design: The proof is verified without revealing any sensitive information, such as the user’s income or identity details. No central authority stores user data, ensuring complete decentralization and security.

- Reusable Credentials: Once verified, users can reuse their zkPoAI credentials across multiple platforms, eliminating the need for repetitive verifications.

With zkPoAI, RWA platforms can seamlessly meet compliance requirements while upholding the privacy and sovereignty of their users.

Why zkMe is the Essential Infrastructure for the RWA Revolution

As the RWA tokenization market expands toward tens of billions in value, zkMe stands as the indispensable foundation enabling this transformation:

The Only Compliant Web3-Native Solution: While others offer traditional KYC solutions retrofitted for blockchain, zkMe provides a truly Web3-native compliance infrastructure that maintains decentralization principles while satisfying regulatory requirements. As the only FATF compliant KYC provider to be fully decentralized, zkMe offers a unique solution to the compliance challenges facing RWA platforms.

Advanced Cryptographic Infrastructure: Our zkTLS and zero-knowledge infrastructure represents significant cryptographic innovation, making zkMe capable of delivering truly private yet verifiable accredited investor credentials.

Universal Chain Compatibility: zkMe credentials function seamlessly across all major blockchain ecosystems, providing the interoperability foundation necessary for global RWA adoption.

Built for Institutional Scale: Our infrastructure is designed to handle enterprise-level verification needs while maintaining the security and privacy guarantees impossible with centralized alternatives.

To discover how your platform can benefit from zkMe's revolutionary Accredited Investor solution with zkTLS technology and position yourself at the forefront of the RWA revolution, explore our comprehensive documentation at docs.zk.me or contact us at contact@zk.me for a personalized consultation.

About zkMe

⭐ zkMe builds web3 protocols and infrastructure for compliant, self-sovereign, and private verification of user credentials. The only web3-native solution for dApps to fulfill user due diligence (KYC) in zero-knowledge natively onchain, without compromises on the decentralization & privacy ethos of web3.

🔖 Use Cases: zkKYC, zk Credit Score, zk GPS Geoblocking, zk Investor Accreditation, Onchain AML & KYT, FHE Anti-Bot/Sybil Protection

🚀Trusted by over 80 projects and with over 1.5 million user credentials, backed by Multicoin Capital, OKX Ventures, Robot Ventures and more. zkMe is the leading onchain compliance provider.

For more information, follow the links below:

Website | Twitter | Discord | Telegram | Telegram Mini app |